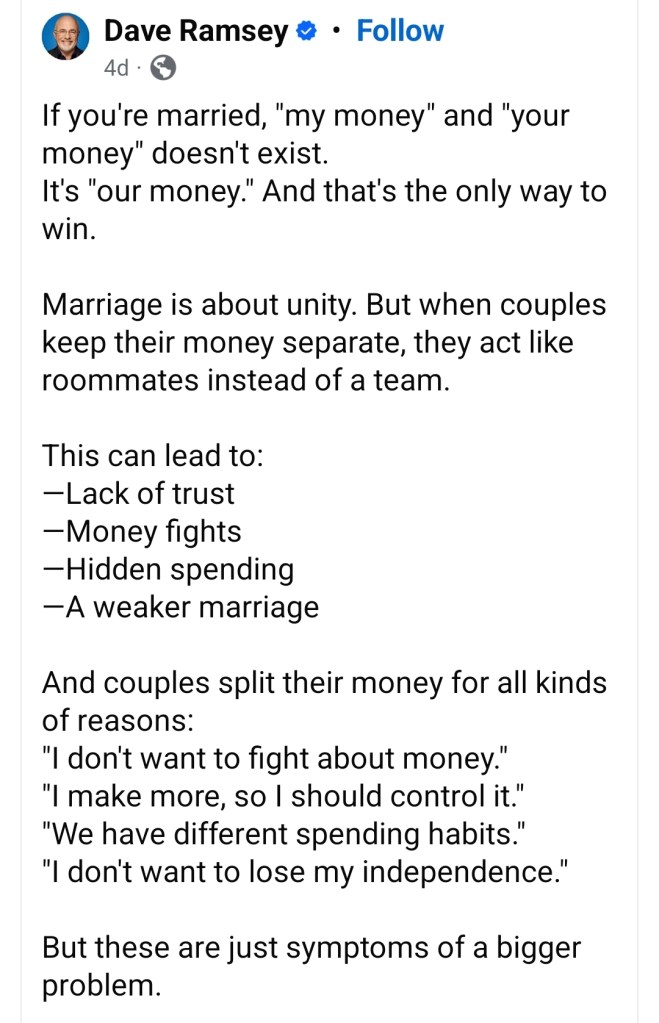

I recently came across the following Facebook post by Dave Ramsey:

Dave proceeds to suggest that spouses should address whatever underlying issue that’s preventing them from sharing finances. While true in theory, this view is incredibly simplistic and naïve.

I agree that in a perfect world, all married couples would be on the same page financially, and would have no reason to keep their money separate. However, this doesn’t always work this way.

I can think of many situations in which sharing finances could, in fact, cause a lot of trouble. Here are just a few:

- One spouse’s destructive financial habits, like compulsive shopping and inability to budget

- Gambling and other addictions

- A spouse carrying debt from before the marriage

- People in blended family situations, i.e., each spouse brings kids from a prior marriage and is responsible for covering their own kids’ expenses

And that’s even without getting into the issue of financial abuse, like one spouse (often a stay-at-home parent or the one who earns less) being blocked from freely using joint accounts and instead getting “spending money” from the main breadwinner.

Reddit is full of stories like this one, with the self-explanatory title of “Recently discovered extent of my wife’s shopping addiction.“ The poster proceeds to tell that his wife blew “$6200 on high end cloths this last month with $5200 the month before that.”

So, according to Dave Ramsey, this couple should work on budgeting and aligning their financial goals. Which is a great suggestion, actually! But what if this doesn’t work out?

Suppose the overspending wife doesn’t acknowledge the extent of her problem. Or, suppose she does and makes an effort to fix it, but relapses. Should the financially responsible husband shoot himself in the foot by sharing funds with his wife at all costs, because “marriage is about unity”?

He could divorce her, of course. Many marriages fall apart because of disagreements over money. But is breaking up the only option if spouses can’t agree on money matters?

Let’s say this Redditor wants to stay together with his wife. Maybe they have a good relationship otherwise, and money is their only major disagreement. Maybe his wife actually wants to improve her spending habits, and maybe she even will at some future point, but in the meantime, what can he do to keep up with mortgage payments and put food on the table?

Separate their finances, obviously. It’s better than drowning together with your spouse because “there’s no such thing as your money/my money anymore.” Overall, I believe everyone should do what works for them, whether it’s shared or separate accounts.

The one problem with the suggestion of separate finances is how does the law view it. Where I live, the government views finances as joint, so the a spouse would be responsible for the other spouses debt.

LikeLiked by 1 person

That’s a valid point – however, at least the spouse prone to acquiring debt wouldn’t be able to dip into the other spouse’s money.

LikeLike

We have several separate accounts, for the reason that we are each responsible for different expenses (he pays mortgage, utilities, etc. I buy groceries, school stuff, etc.) and know how much we need to cover our own. That way it is easier to keep track of the budgets without burdening one spouse or overcomplicating matters. We do have both names on all accounts in case someone needs to handle the other’s bills for some reason, but don’t ordinarily feel the need to meddle.

LikeLiked by 1 person

Sounds like a very practical and workable system!

LikeLike